Do you feel overwhelmed by the never-ending task of bookkeeping? It doesn’t have to be that way! Here are a few tips and tricks to simplify the process and keep your financial records in tip-top shape.

1. User-friendly software

There are many user-friendly accounting software options available that can help streamline the bookkeeping process and make it easier to track expenses, income, and financial transactions.

2. Pay with credit cards or checks

Try to make all your payments with a credit card or a check so that you can get a digital statement each month from your bank / credit card company. It becomes very easy to copy and paste the information from such statements into any software you may be using.

3. Take photos of receipts

Take photos of your receipts especially for cash payments. All your receipts will stay organized by date on your phone and no expense will get overlooked or forgotten when you need to deduct it

4. Set aside some time on a weekly / monthly basis

You can do your bookkeeping on a day-to-day, weekly, monthly or even annual basis. But it helps if you set some time aside to keep your financial records in order. It’s also a great way to keep track of how your business is doing

5. Separate personal and business finances

Keep personal and business finances separate to avoid confusion and make bookkeeping easier. Consider setting up a separate bank account and credit card for your business expenses.

Bookkeeping can actually be very rewarding as it shows you how well your business is doing and which areas can profit from more attention.

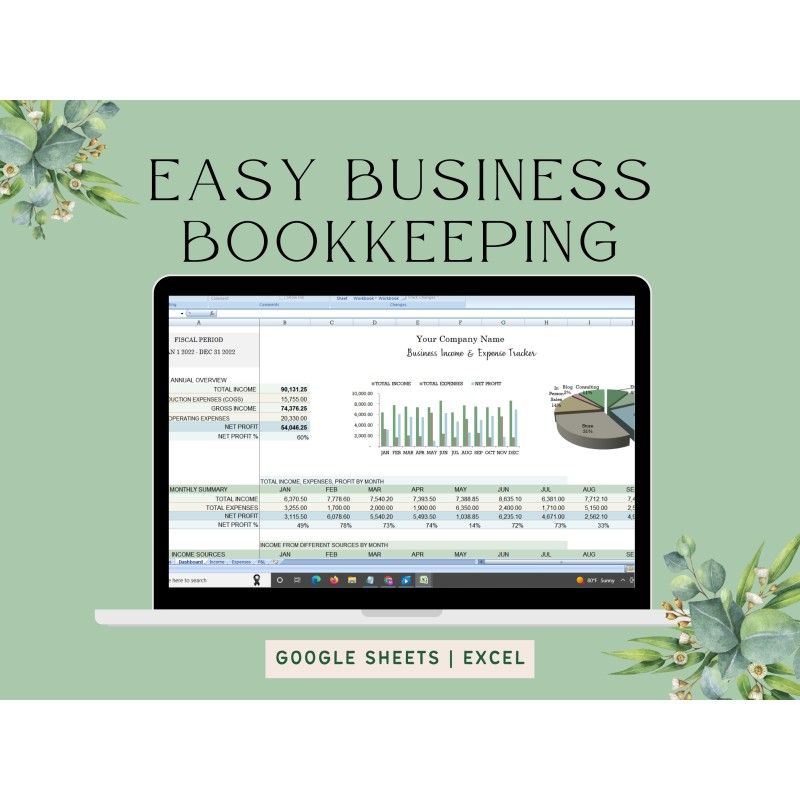

My Business Bookkeeping Spreadsheets and Rental Income & Expense Trackers are meant to make bookkeeping as easy as possible. There is little to no set up required and you can start entering transactions right away. You can even just copy and paste your expenses from your statements saving you a humongous amount of time.

Leave a Reply