If you’re a small business owner or self-employed, you know that tracking income can quickly become a headache—especially when sales tax comes into play. Some items have sales tax, others—like services or labor—don’t, and some products might even have a different sales tax rate altogether. The result? Confusion and messy records.

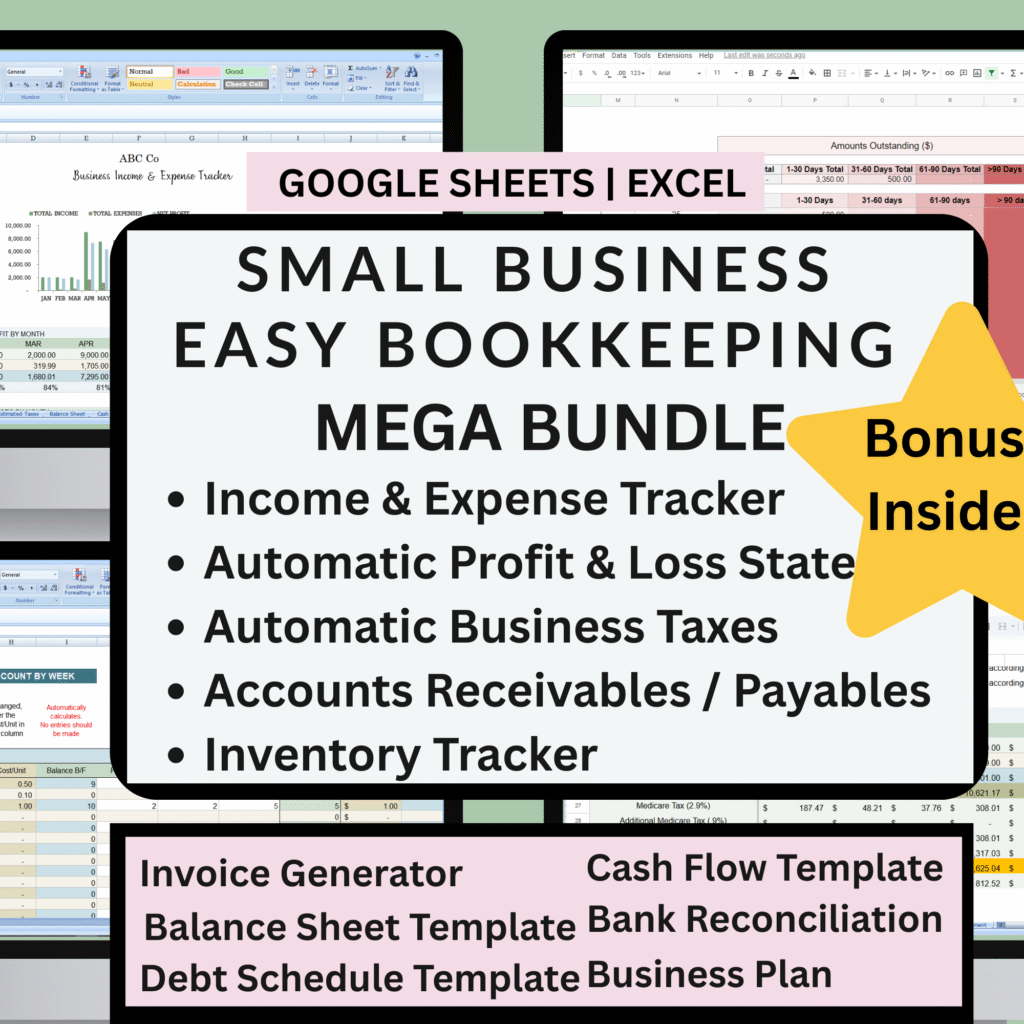

Let’s cut through the chaos! I’ll show you how to cleanly record each transaction without driving yourself crazy, using my Business Bookkeeping Spreadsheet.

The Problem: Sales Tax Confusion

Imagine this scenario: You’re entering transactions for your business, and suddenly you realize that some items are taxed at 5%, others at 7%, and some not at all. How do you keep it all straight without making costly mistakes? Manually calculating tax for each item is not just tedious—it’s error-prone.

The Solution: A Simple, Automated System

That’s where my Business Bookkeeping Spreadsheet comes in! With the Income tab, each transaction gets entered in its own row, and each transaction can have its own sales tax. You can set the rate individually—whether it’s 5%, 7%, or zero—and the spreadsheet automatically calculates the sales tax for you. No more manual math, no more guesswork!

Step-by-Step: Entering a Transaction

Let me show you how easy it is. For example, let’s enter a transaction from January 15th. Say it’s for website income of $5,000 with a sales tax of 7%. You simply enter the date, the income amount, and the sales tax rate, and the spreadsheet takes care of the rest—automatically calculating the sales tax. You can also include a product ID, description, and any notes.

See Your Totals Instantly

On the top of the Income tab, you’ll see your key figures at a glance: total income, sales tax, and overall income after tax. Plus, the dashboard provides a comprehensive breakdown of your income, expenses, and net profit—both monthly and annually. It even categorizes income and expenses, so you know exactly where your money is coming from and where it’s going.

Save Yourself a Few Gray Hairs

Managing income and sales tax shouldn’t be a source of stress. This spreadsheet makes it easy to record transactions accurately and stay organized. No more errors, no more confusion—just clean, reliable bookkeeping.

If you’re ready to streamline your business finances, grab the Business Bookkeeping Spreadsheet at the link below. Save yourself time and hassle—your future self will thank you!

Leave a Reply